Pocket Option and Close Option Strategy with Signal from Trading View

Do you want the PDF to keep right away? Download it here for free

This strategy opens operations as soon as a change in trend is confirmed by the crossing of the lines of two RSI indicators with different parameters.

The idea consists in superimposing the lines of two RSIs with different settings, to check what happens at the moment of crossing. It turned out to correspond to a change in market direction.

To be able to superimpose two indicators, a platform is needed that allows this possibility. The choice therefore fell on Trading View.

Configuration

We operate on the EUR/USD Pocket Option or Close Option market.

If you don’t have these brokers yet you can sign up via these links:

Link always valid Close Option

Chart preparation

We use:

- RSI Indicator Parameter 21

- RSI Indicator Parameter 5

- New candle opening entrance

- Pocket Option or Close Option Chart

- EUR/USD, USD/JPY or other pairs with good trading

- 1 minute candles and 1 minute expiration

Trading platform preparation

To start we install two identical RSI indicators:

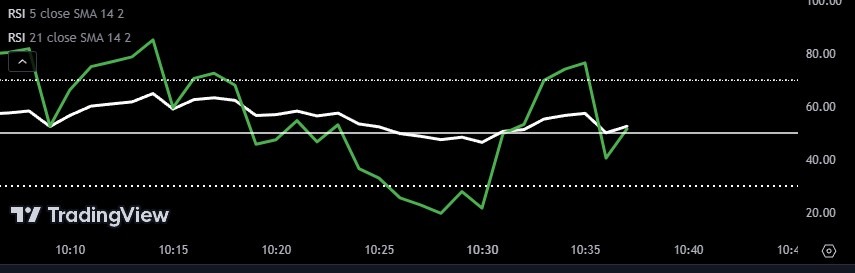

After installing the two RSI indicators with the recommended parameters and colors of your choice, this is how the graph appears on Trading View

In the figure below we see the two RSI indicators positioned one above the other in the same graph.

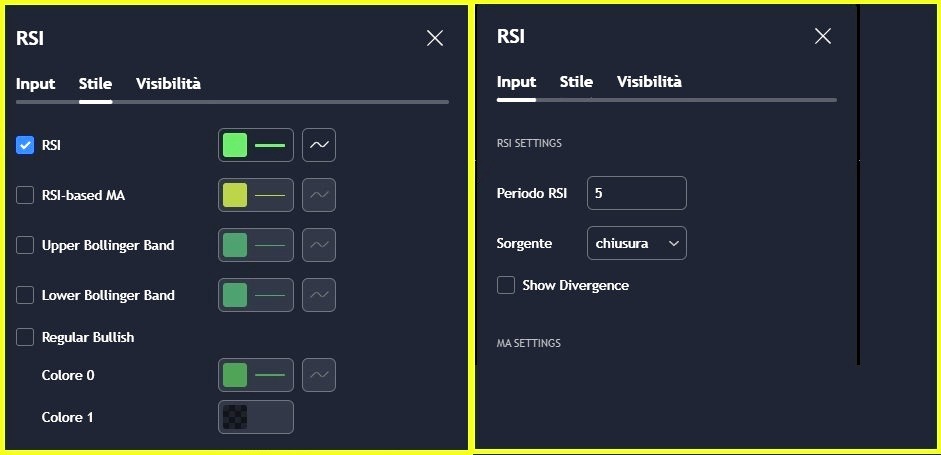

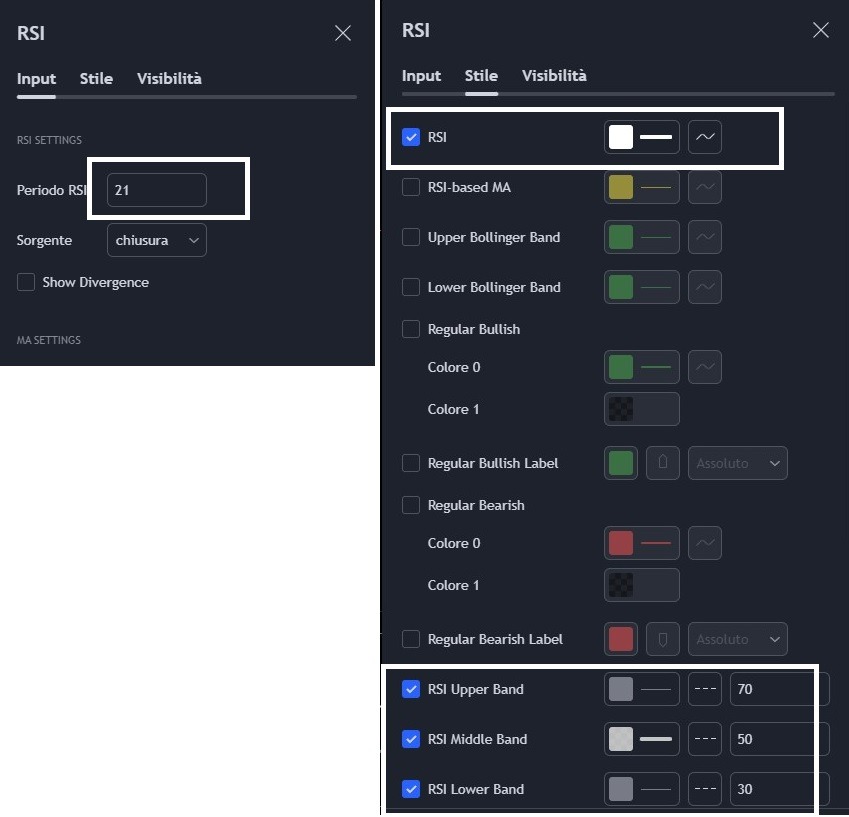

Here’s how to proceed and how to set the adjustments:

RSI Parameter 5. Leave only the RSI box activated.

RSI Parameter 21

Activate only RSI and level lines.

How to insert the two indicators in the same window.

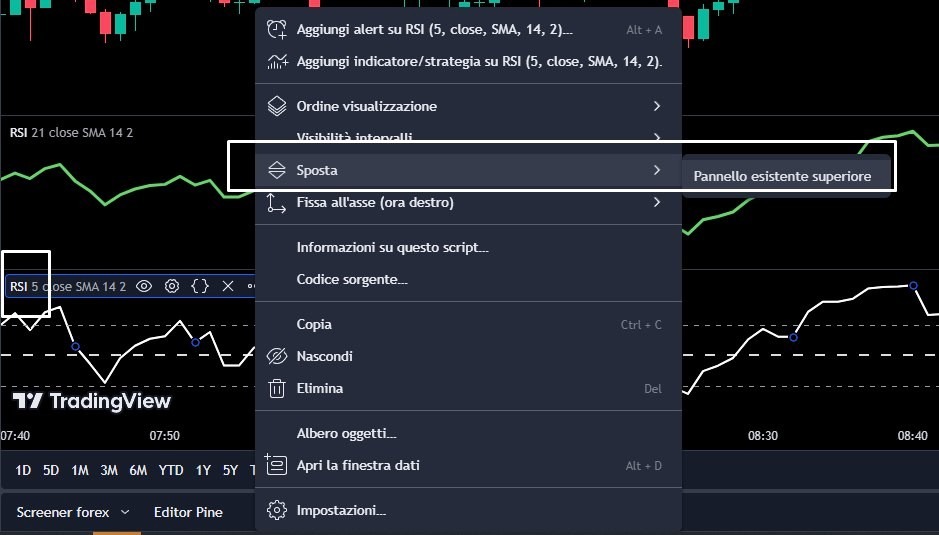

After parameter adjustments the indicators are located in two separate windows:

Overlay indicators in the same window

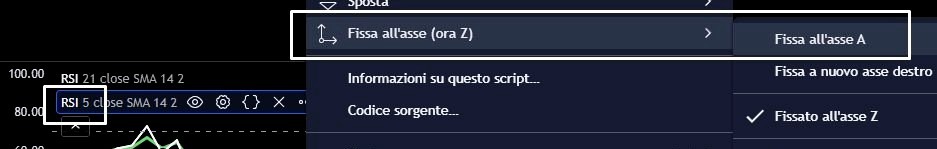

To superimpose the upper one on the lower one, click on the 3 dots of RSI 5:

Then “Move to Top Panel”:

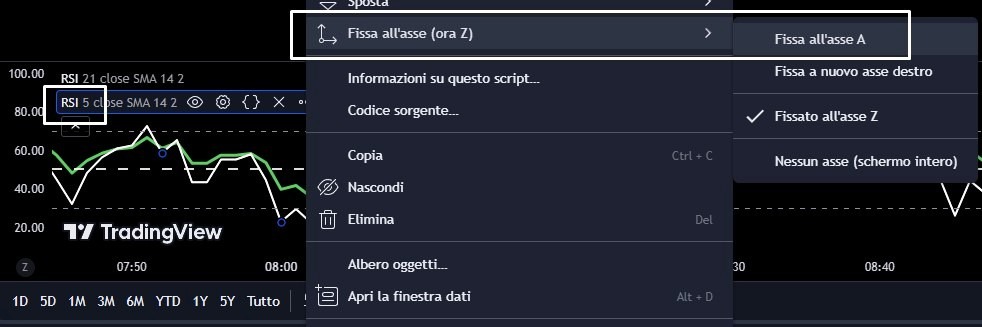

Click again on the 3 dots of RSI 5:

And then ”Fix to A axis”

Here are the two indicators in the same window:

Finally, check that both curves are fixed to the A axis:

The video examples help to understand better.

Identify the trend

When the RSI curve is above the zero center line, the trend is bullish. Bearish when on the contrary it is below this line. It is therefore important to open positions with a direction corresponding to the ongoing trend.

Entry rule

The operation opens after the crossing of the lines of the two RSIs.

The operation opens at the next candle opening.

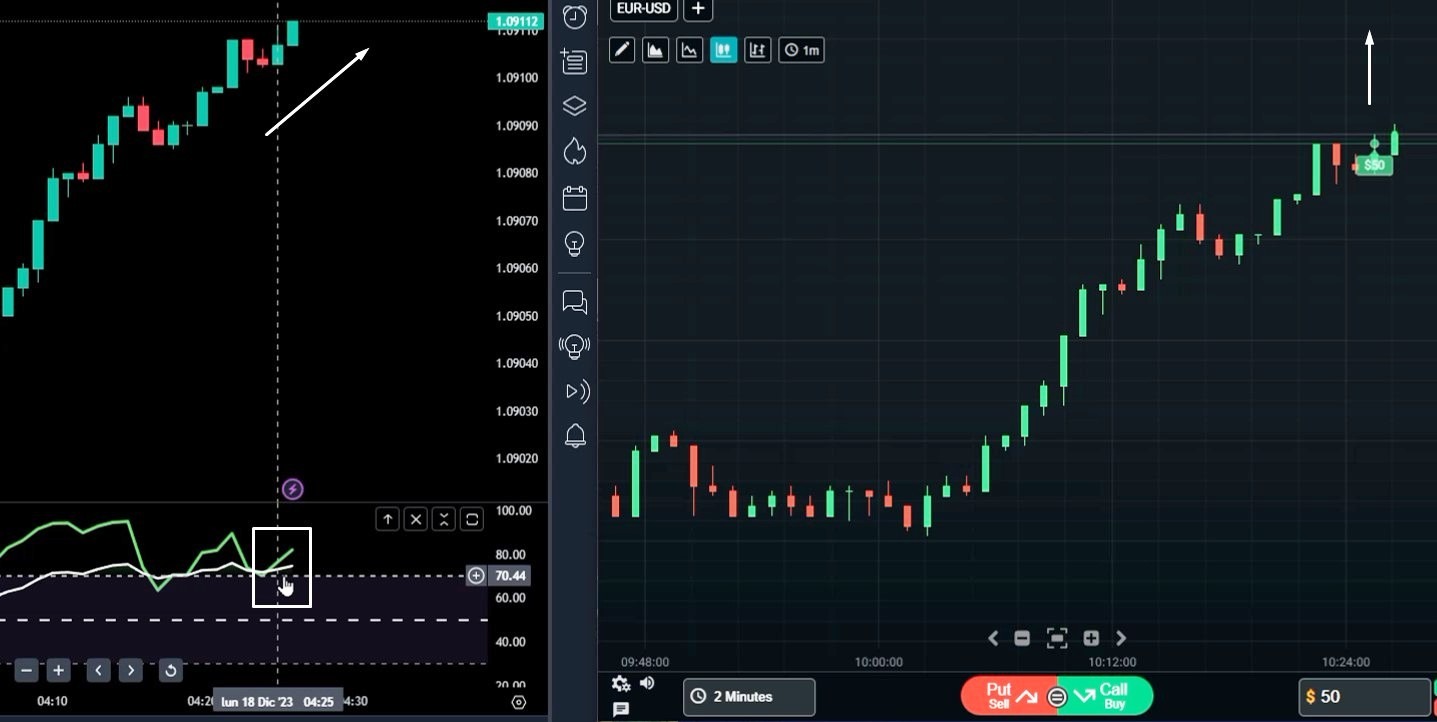

Example of Call opening.

The white line (RSI 21) is ABOVE the center line.

The green line (RSI 5) crosses it to the upside.

The example combines Trading View and Close Option

Another Call example with Trading View and Pocket Option:

Example of PUT opening

The white line (RSI 21) is BELOW the center line.

The green line (RSI 5) crosses it to the downside.

Supports and Resistances

In the presence of these levels the price may not follow the expected direction.

Draw lines before opening trades.

Lateral market

Do not operate during these phases. They are identified by the RSI 21 line (white) which remains close to the central line of the indicator:

Observations and advice

- The strategy is valid for any time frame. It works well respecting the proportions, for example even with 5 minute candles and 5 minute expiry, but more patience is needed to wait for the signals.

- Avoid low volatility markets (small candles that barely move). Trade when the market is buoyant.

- We do not operate during lateral phases of the market.

- If you miss a couple of consecutive trades, stop and analyze, something is wrong with your operations.

- Start with the demo, then with a minimum amount, just to test the market and see if everything is calm. Raise the stakes gradually.

- Do not invest more than 5% of the capital in a single operation. 1% or 2% is a reasonable choice.

Conclusion

We hope you have found the simple yet effective system to earn profits.

Watch and review the video examples with tutorials on YouTube to understand the rules well.

Now we ask you for a small, but big favor for us, if you watch the video examples, click like on the YouTube video, and subscribe for any updates.

Furthermore, your comment on this matter on our Binary Options Telegram would be very useful .

Thank you and Happy Trading!