The Bollinger Bands. One of the most used binary options trading indicators.

But are Bollinger Bands still useful? How do they adjust? Alone or with other indicators?

We have already recently talked about trading based on a moving average and then on two moving averages.

If we wanted to use 3 moving averages, we could install the Bollinger Bands indicator , which is based on 3 of these averages.

The purpose of the bands is to give a relative view of above and below . Thus, in theory, prices are high in the upper band and low in the lower band.

In this article we see how to set the parameters according to our trading needs, and for those who want to go further, a more complete application with matching RSI indicator.

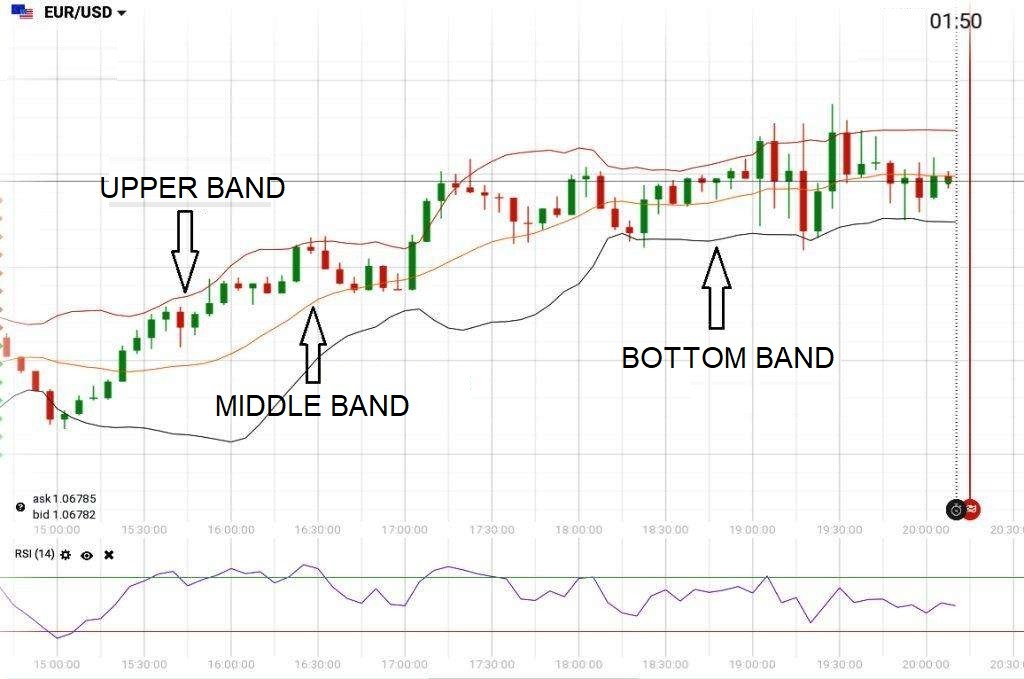

What are Bollinger Bands? If you have never used this indicator in the past, take a look at the graph in the figure to see what the Bollinger Bands look like :

Image of the Bollinger Bands in the IQ Option trading platform . The indicator is present by default on most platforms.

What are Bollinger Bands

Bollinger Bands, also known as “Bollinger Bands” are well known in the trading community.

They are named after their creator, John Bollinger, who made them known in the early eighties. The purpose of these bands was to give a relative definition of upper and lower. Thus, in theory, prices are high in the upper band and low in the lower band.

Bollinger Bands include three different lines , upper, middle, lower . The midline typically serves as the basis for both the upper and lower lines. They are mainly used to determine when prices are overbought and oversold. From this it can be deduced that it is convenient to sell when prices touch the upper band and buy when prices touch the lower one.

Volatility

The space between the bands is determined by “volatility” , i.e. how much the price action varies over time. A high volatility, for example, indicates a high trading volume. Many trading strategies are often more used in the presence of high volatility, as more reliable signals are obtained.

The central or median band consists of a 20-period moving average , while the upper and lower bands have a standard deviation from this, which in practice means that the width of the bands yields a statistical measure of the volatility of the market.

When you see the broad bands it means that we are in the presence of high volatility , narrow bands low volatility .

Video Tutorial Bollinger Bands

In the video a brief but understandable description of the Bollinger Bands:

https://www.youtube.com/embed/CnJYMmU6c7k

Bollinger Bands is an indicator that provides a range of movement in the price of an asset .

It is created, as already mentioned, on the basis of three moving averages , one of them in the center, the other two at an equal distance from it.

Bandwidth

The price touches one of the Bollinger Bands

Bandwidth is calculated according to a mathematical standard deviation formula. It is possible to set the coefficient in the indicator settings. The higher this is, the wider the band will be and the price chart will touch the margins more rarely.

Wide corridor = higher volatility

Period

Another adjustment concerns the value of the period , i.e. the number of candles used in calculating the value of the indicator. The increase in the period “smooths” the corridor but does not guarantee an increase in the accuracy of the indicator readings.

When the price reaches or touches one of the lines, the probability of its movement shifts in the opposite direction.

Breaking any of the lines signals a probable trend move through the perforation . The higher the market volatility , the wider the corridor. Prolonged presence of the indicator in a narrow corridor usually precedes the start of a strong movement in the market.

The use of Bollinger Bands in association with other indicators (indicators/oscillators such as Stochastic or RSI) is recommended as it is ineffective during a strong trend.

Trading strategy with Bollinger Bands + RSI

The most classic of binary options strategies which involves the combined use of two well-known indicators:

- BOLLINGER BANDS

- RSI INDICATOR (Relative Strength Index)

The Bollinger Bands Strategy with RSI is perhaps the most popular band trading system.